Accessing Europe's biggest digital health market: DiGA reimbursement in Germany explained

Accessing Europe's biggest digital health market: DiGA reimbursement in Germany explained

Germany’s pioneering 'apps on prescription' model offers the most structured entry point into the European digital health and medtech market. With access to 73 million insured lives, the potential for scale is unmatched, but the barrier to entry is high. This guide breaks down the essential steps for securing DiGA reimbursement in Germany, from navigating the BfArM Fast-Track and building the right clinical evidence, to preparing for the major regulatory shifts arriving in 2026.

Why Germany should top your EU digital health launch plan

If you’re building a regulated digital health product, Germany should sit at the top of your EU launch roadmap: it is Europe’s largest economy, with ~84 million people and a statutory insurance base covering ~88 % of residents (1, 2, 3).

Germany also pioneered the first national “apps on prescription” model: since 2020 its DiGA programme lets physicians prescribe approved digital health apps, with costs borne by statutory health insurance (4, 5). The scale is compelling: more than 170 000 physicians and associated healthcare professionals in Germany can prescribe DiGAs to around 73 million insured people (6, 7).

Other markets are beginning to mirror this approach. In 2024, France introduced the PECAN (Prise en Charge Anticipée Numérique) fast‑track reimbursement pathway for digital health applications and telemonitoring systems (8). The UK has also proposed a national Health Store apps marketplace, with evaluation aligned to NICE evidence standards (9,10).

Beginning in 2026, the DiGA scheme will evolve: mandatory outcomes monitoring, at least 20 % of price tied to performance, and eligibility extended to higher‑risk class IIb devices (12).

Who is DiGA for? Criteria for digital health applications

DiGA is intended for digital health applications that deliver a direct therapeutic benefit to patients. These are typically digital therapeutics that actively treat, monitor or alleviate a diagnosed condition through the software itself, such as mental health programmes, symptom-management tools, or structured self-management interventions. Preventive wellbeing apps, clinician-only tools and products whose main function is data collection do not qualify. Currently DiGA is limited to software-based medical devices in Class I or IIa. From 2026, the scope will widen to include certain low-risk Class IIb digital medical devices.

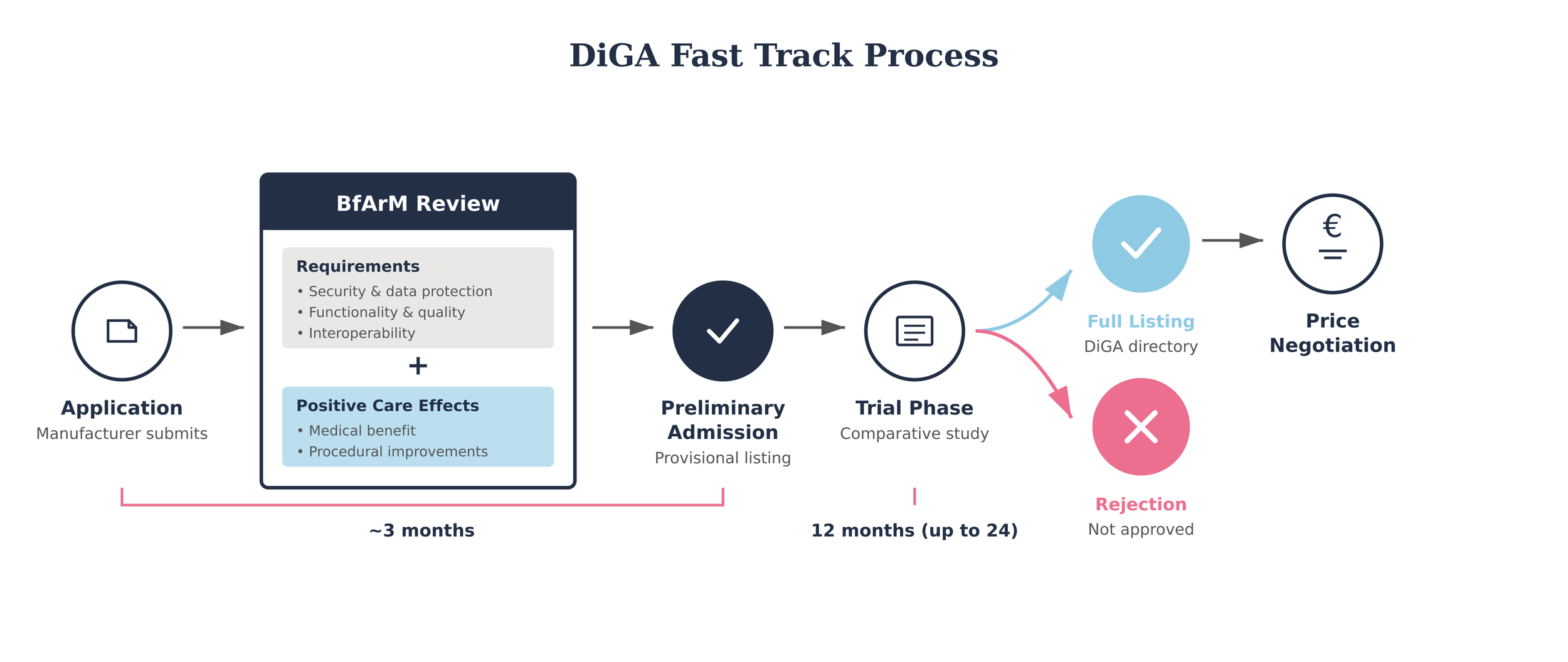

How to get listed on the DiGA directory: the DiGA Fast-Track process

“It is based on the fundamental assumption that digital applications must be safe and easy to use to be successfully established in healthcare.” – BfArM 2023 (6)

Germany’s DiGA Fast‑Track is one of the clearest and most structured reimbursement pathways for digital health apps worldwide. The Federal Institute for Drugs and Medical Devices (BfArM) reviews applications under a three‑month timeline: once a company submits a complete file, BfArM must decide on inclusion in the directory within 90 days (13).

Technical criteria

To be eligible, an app must first meet technical requirements. These include classification as a Class I or IIa medical device under the European Medical Device Regulation (MDR). However, the scope is widening and, starting in 2026, eligibility will extend to include Class IIb devices (more on this below). Other technical requirements include compliance on security, data protection and privacy, and interoperability. The therapeutic function must also be delivered through the app’s digital technology itself, rather than solely through data collection or device control (12, 13).

Evidence criteria

Every application must demonstrate a positive healthcare effect. This can be shown either as a direct medical benefit — for example, symptom reduction or measurable health improvements — or as a structural and procedural improvement, such as enhanced access, coordination or delivery of care in ways that matter to patients (12). Comparative studies are expected to substantiate these claims.

Digital therapeutics focus

These requirements mean that DiGA is primarily suited to digital therapeutics (DTx). These are evidence‑based software products designed to treat a disease, disorder, condition or injury and deliver measurable therapeutic impact. Unlike apps used solely by clinicians or those designed for prevention, DiGA is conceived as a “digital assistant” in the hands of the patient, used either independently or alongside their healthcare provider (12, 13).

Listing in the DiGA directory: provisional vs permanent

“From the day an app enters the directory … more than 170 000 physicians, dentists and psychotherapists can prescribe DiGA to the country’s 73 million insured persons.” – BfArM 2023 (6)

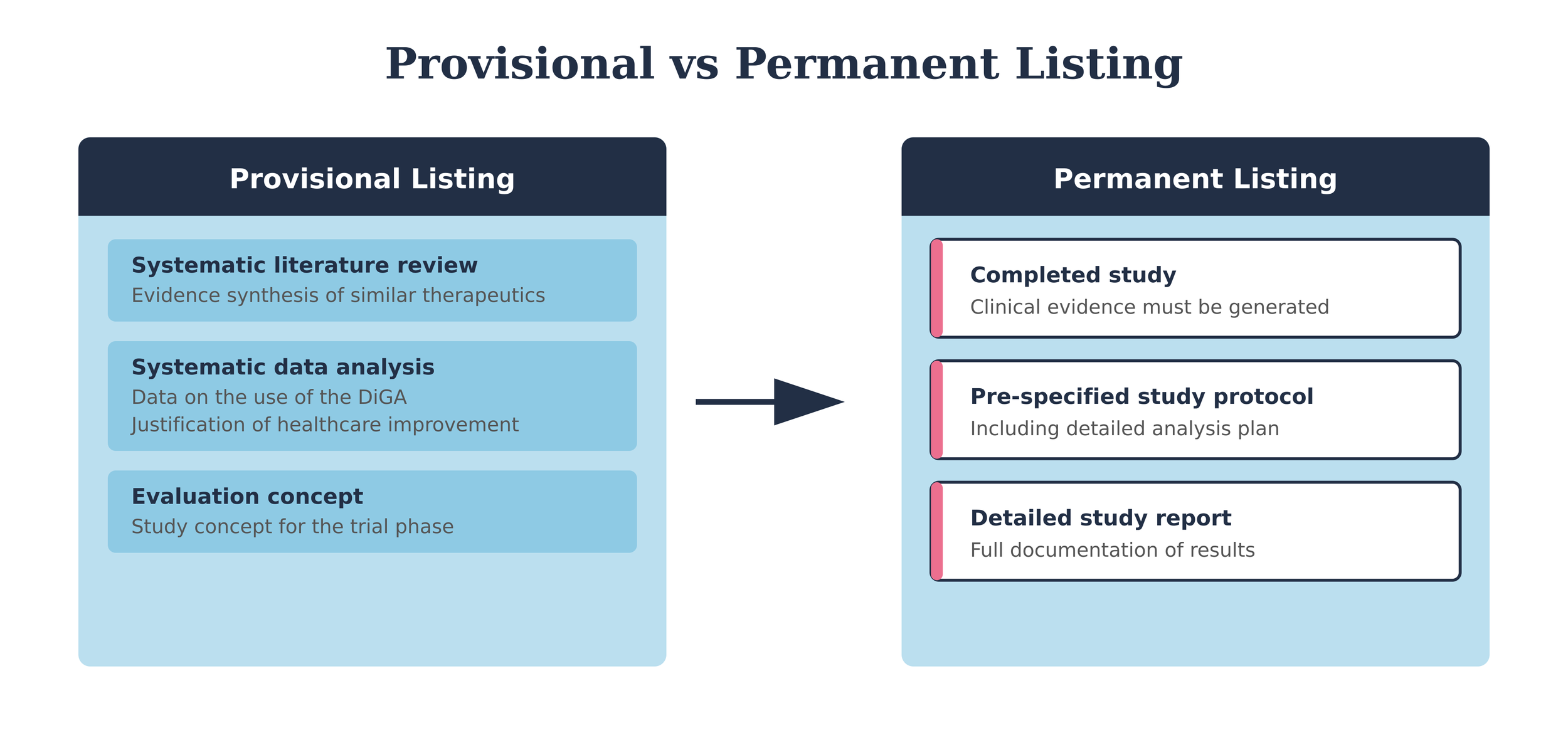

Apps may be listed before definitive evidence is generated, on the basis of preliminary evidence demonstrating the plausibility of a positive healthcare effect. If a manufacturer meets all technical and quality requirements but does not yet have sufficient evidence of a positive healthcare effect, it can apply for a provisional listing in the DiGA directory. This pathway allows innovators to access reimbursement while completing the required clinical studies. To qualify, the app must already comply with standards for security, functionality, quality, data protection, and information security. Evidence of a positive healthcare effect may subsequently be generated within a twelve-month evaluation period.

🔎 Provisional Listing: Evaluation Concept

Alongside the provisional application, manufacturers must submit an evaluation concept that follows accepted scientific standards and builds on their data evaluation. This includes the planned study protocol, justification of outcomes and comparators, and an explanation of how the study reflects real-world healthcare practice.

Critically, the concept must be validated by a manufacturer-independent organisation with no financial or organisational ties to the company. While manufacturers cover standard costs, independence is required to avoid conflicts of interest.

The evaluation concept must be robust enough to show that the intended study can generate valid evidence of a positive healthcare effect.

📩 Get in touch to see how we can help design your independent evaluation concept.

Reimbursement status does not differ between provisional and permanent listings. From the day an app enters the directory, it is eligible for full nationwide reimbursement within Germany’s statutory health insurance (SHI) system.

This means that more than 170 000 physicians, dentists and psychotherapists can prescribe DiGA to the country’s 73 million insured persons. This creates immediate market access across the largest insured population in Europe (6).

A manufacturer must submit evidence within a 12 month window of preliminary approval. If a manufacturer does not submit study results within the trial phase, or if BfArM refuses the application, the product is removed from the directory. The regulator does not allow repeated provisional listings, underscoring that the trial phase is a one-time opportunity.

Building evidence that regulators accept

“Evidence is the most critical aspect with regard to withdrawals and rejection.” – BfArM, 2023

What counts as evidence?

Every DiGA must demonstrate a positive healthcare effect (pVE) to secure permanent listing. Regulators recognise two categories:

Medical benefit (medizinischer Nutzen, mN): patient outcomes such as improved health status, reduced disease duration, longer survival, or better quality of life.

Patient benefit (patientenrelevante Struktur- und Verfahrensverbesserungen, pSVV): improvements in care delivery that matter to patients, e.g. better coordination, guideline adherence, adherence support, safer medication use, improved access, higher health literacy, greater autonomy, help coping with illness day-to-day, or reduced treatment burden for patients and families.

Efficiency gains for clinicians or insurers are not considered for inclusion as endpoints. The benefit must be tangible for patients. However, whilst economic outcomes do not count towards DiGA listing, they can strengthen a manufacturer’s position in later price negotiations — making them a valuable complement to clinical evidence.

💡 So what? Vendors need to demonstrate patient benefit

Vendors must frame outcomes in patient terms, not system savings — a shift for many digital health apps.

German-specific requirements

DIGA requires that evidence be generated locally. Studies must generally be conducted in Germany to reflect the reality of local care pathways, provider interactions, and patient populations. Data from other countries is only acceptable if comparability to the German context is rigorously demonstrated.

In addition, studies must be registered in a WHO-approved registry (e.g. DRKS in Germany), and results — positive or negative — must be published within 12 months of study completion. Reports must follow international standards such as CONSORT to ensure transparency and credibility.

💡 So what? German data is non-negotiable

Plan early for studies in Germany. Foreign data won’t get you listed unless you prove equivalence with the German healthcare context. Partnering locally for recruitment and study execution is essential.

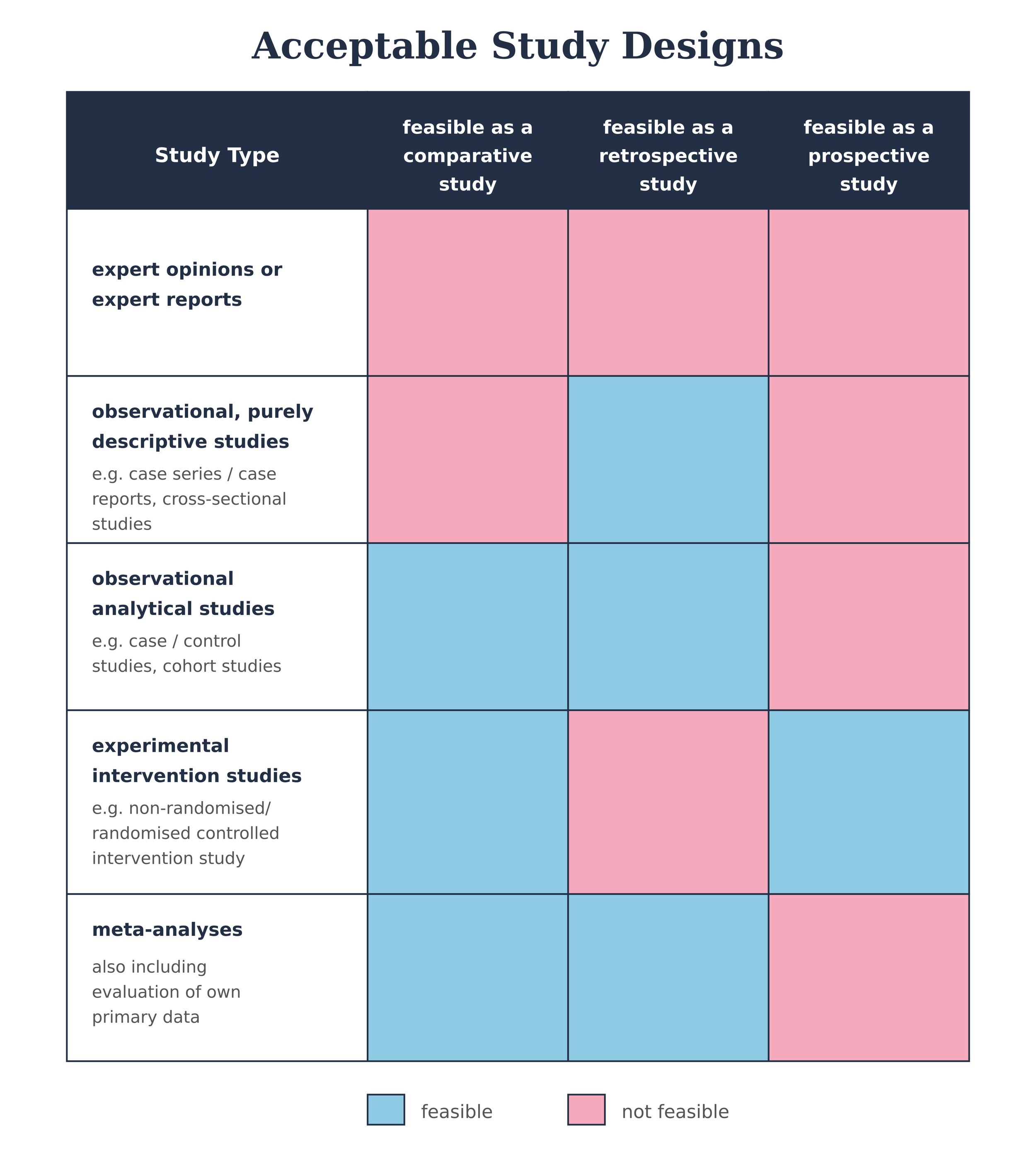

Study design and methodology

Evidence must come from a quantitative comparative study showing that outcomes with the DiGA are superior to a control group. Acceptable comparators include standard care, no treatment, or another DiGA already permanently listed.

Minimum requirement: retrospective comparative study (case–control, retrospective cohort, or intra-individual comparisons).

Higher standard: prospective studies (non-randomised or RCTs) carry more weight and reduce risk at both evaluation and pricing stages.Alternative designs: pragmatic trials and the integration of real-world data can be considered if justified — but require early discussion with BfArM.

💡 So what? Study design choices matter

Retrospective studies may secure listing quickly and cheaply, but they carry higher risk of rejection or weak pricing leverage later on. Prospective, well-powered studies cost more up front but pay off in negotiations.

Why evidence matters for pricing

Evidence plays an important role not only in achieving permanent listing but also in subsequent price negotiations with the GKV-Spitzenverband. Once the free-pricing period ends, reimbursement levels are often adjusted downward through negotiation or arbitration. While the magnitude of any reduction varies case by case, the overall strength and credibility of the clinical evidence can influence a manufacturer’s negotiating position, but is one of multiple factors.

Prospective, well-designed studies demonstrating clear patient-relevant benefits can help support arguments for maintaining a higher reimbursement level. By contrast, more limited evidence may still be sufficient for listing but can leave less room to manoeuvre in later pricing discussions, particularly where other supporting factors are weak.

💡 So what: Evidence and pricing power

Evidence does more than enable market access. It shapes the context for price negotiations. Strong clinical data can strengthen a manufacturer’s position once free pricing ends, even though pricing outcomes are ultimately determined by a broader set of considerations.

DiGA pricing and reimbursement

Free pricing window

Manufacturers can set prices freely when a DiGA is first listed in the directory. This free-pricing period differs depending on whether the listing is permanent or provisional.

Permanent listing: Price negotiations with the GKV-Spitzenverband (National Association of Statutory Health Insurance Funds) begin four months after listing. Negotiations run for up to five months, followed by up to three months of arbitration if no agreement is reached. The agreed or arbitrated price applies from the 13th month onward.

Provisional listing: Manufacturers can set prices freely during the entire provisional phase, which may last up to 12 months while evidence is generated. After the trial phase, BfArM has three months to decide on a permanent listing. Only then do negotiations with the GKV-SV begin, following the same five-month negotiation and three-month arbitration timelines as permanent listings.

Does DiGA guarantee adoption? Strategies for successful integration with the German healthcare system

Getting onto the DiGA directory does not guarantee adoption. Companies need a clear scaling strategy that shows where the product fits within real clinical pathways, backed by practical education and awareness-building for both clinicians and patients. This includes helping doctors understand when and how to prescribe the app, supporting patients to use it effectively, and ensuring the product integrates smoothly into routine care. Alongside this,continuing to strengthen a product's evidence base over time can help differentiate from competitors.

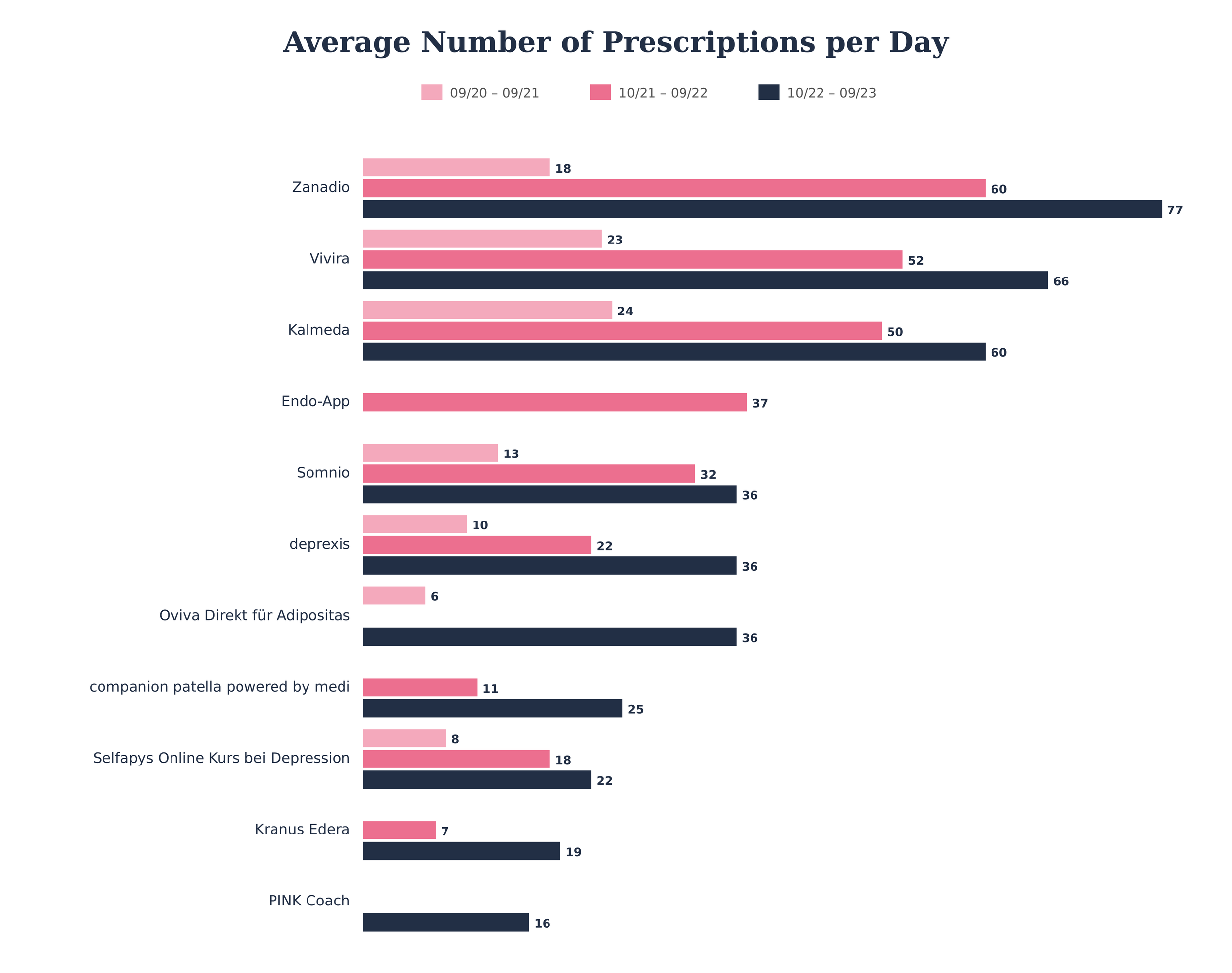

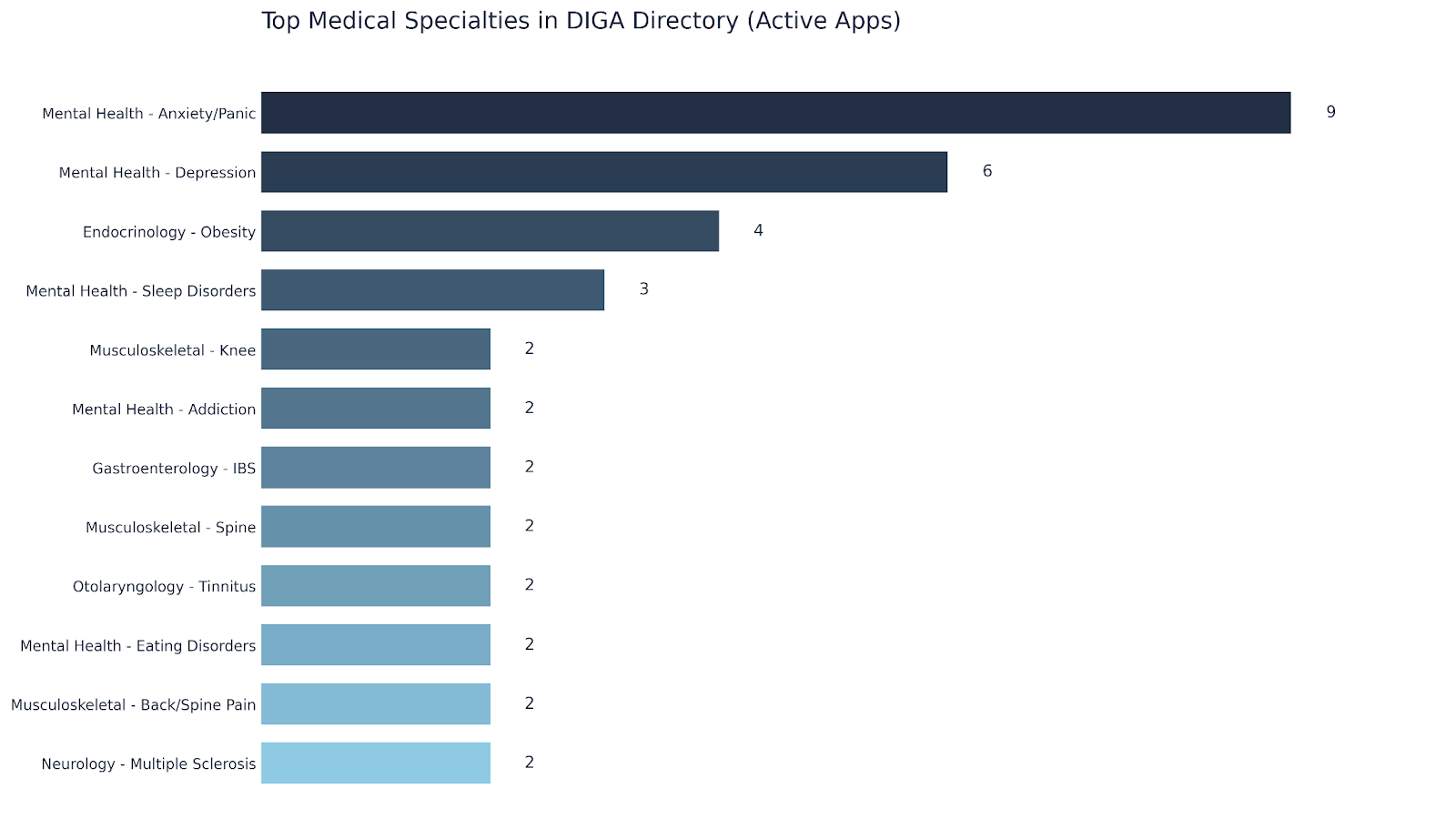

Source: Goeldner M, Gehder S. Digital Health Applications (DiGAs) on a Fast Track: Insights From a Data-Driven Analysis of Prescribable Digital Therapeutics in Germany From 2020 to Mid-2024J Med Internet Res 2024;26:e59013 URL: https://www.jmir.org/2024/1/e59013 DOI: 10.2196/59013

Source: Prova Health internal analysis, July 2025

As of late 2025, a total of 56 DiGAs are listed by BfArM, comprising 48 permanently listed and 9 preliminarily listed applications. Mental health is the most common DiGA category, including applications for anxiety, depression and sleep disorders. Endocrinology represents the next most prominent category, driven predominantly by obesity-related applications.

Pricing

DiGA pricing is marked by a contrast between initial and final reimbursement levels. Launch prices typically range between €200 and €700 per three-month prescription (median €514). Following price negotiations or arbitration with payers, costs are usually cut by around 50%, resulting in a much lower median of €221.

Adoption and prescriptions

Prescriptions increased from approximately 41,000 in 20/21 to 209,000 in 22/23. The top 15 DiGAs accounted for 82 % of all prescriptions, ranging between 8 and 77 daily prescriptions each (5).

What’s changing with DiGA in 2026 and beyond?

This year, in 2026, the DiGA framework will undergo its most significant update since launch. Three changes stand out for innovators, investors, and payers:

Application-accompanying performance measurement (AbEM).

Manufacturers of permanently listed DiGAs will need to collect and report real‑world outcome data for their products, and from 2026 at least 20 % of the reimbursement price will depend on measured performance.

Performance-based pricing.

Contracts between DiGA manufacturers and payers must include success-dependent price components from 2026 onwards. This ties reimbursement more closely to measurable outcomes in practice.

Expansion to higher-risk devices.

The Digital Act extends eligibility to Class IIb medical devices, opening the DiGA pathway to more complex therapeutic applications and remote monitoring solutions.

💡 So what? Adoption and evidence of this is essential for longer term DiGA success

Future success in the DiGA programme will depend less on getting listed, and more on proving sustained, real-world effectiveness. Innovators should plan early for evidence generation, patient survey integration, and outcome-linked pricing models.

🔎 So, is DiGA right for my digital solution?

DiGA is a fit if your product delivers a direct, patient-relevant therapeutic effect through software alone, is classified as a Class I, IIa or IIb medical device, and can generate robust comparative evidence of benefit in the German care context. It is less suitable for preventive wellbeing apps, clinician-only tools, or solutions whose primary purpose is data collection or workflow efficiency.

📩 If you’re unsure whether your product meets the criteria, or how your roadmap could be adapted to make it eligible, get in touch and we can help assess fit and outline the pathway.

Ready to secure DiGA reimbursement in Germany?

Accessing Europe’s largest healthcare market is a massive opportunity, but navigating the DiGA Fast-Track process requires a smart strategy. Alongside getting listed, you will need an informed plan for generating robust DiGA clinical evidence to satisfy BfArM and preparing early for critical DiGA pricing negotiations.

With the regulatory landscape evolving, including the expansion to DiGA Class IIb devices in 2026, you need a roadmap that is future-proof.

At Prova Health, we specialise in designing and delivering independent evaluations and market access strategies that innovators need to get their solutions adopted and reimbursed.

Contact our team or get in touch at hello@provahealth.com to discuss how we can support you on your evidence and reimbursement journey.

Contributors

This article was written by Dr Mehul Petul. We’d also like to extend our many thanks to Dr Matthew Fenech, Co-Founder & CMedO at Una Health, for his expert contributions to this piece.

References

GTAI, 2025 – Economic Overview Germany: Market, Productivity, Innovation – Germany Trade & Invest (PDF): https://www.gtai.de/resource/blob/686860/5429e4ed74994d577581dde27ebee597/20250319_EOG_Web.pdf

Commonwealth Fund, 2020 – “Germany” in International Health Care System Profiles: https://www.commonwealthfund.org/international-health-policy-center/countries/germany

IMF, 2024 – “Germany and the IMF” country overview: https://www.imf.org/en/Countries/DEU

BfArM, 2024 – “Digital Health Applications (DiGA) – Interesting facts”: https://www.bfarm.de/EN/Medical-devices/Tasks/DiGA-and-DiPA/Digital-Health-Applications/Interesting-facts/_artikel.html

Goeldner M., Gehder S., 2024 – Digital Health Applications (DiGAs) on a Fast Track: Insights From a Data‑Driven Analysis of Prescribable Digital Therapeutics in Germany From 2020 to Mid‑2024 – Journal of Medical Internet Research 26:e59013: https://www.jmir.org/2024/1/e59013

BMG Guest Article, 2024 – “Guest article: Dr. med. Andreas Gassen” on the Long COVID initiative: https://www.bmg-longcovid.de/en/discourse/guest-articles/guest-article-andreas-gassen

G_NIUS, 2024 – “Prise en charge anticipée numérique (PECAN)” fact sheet: https://gnius.esante.gouv.fr/fr/financements/fiches-remboursement/prise-en-charge-anticipee-numerique-pecan

ICT & Health, 2024 – “PECAN: France’s fast‑track scheme for digital health applications”: https://www.icthealth.org/news/pecan-frances-fast-track-scheme-for-digital-health-applications

UK Parliament, 2025 – Written statement HCWS756, The Government’s plan to prevent ill health (30 June 2025): https://questions-statements.parliament.uk/written-statements/detail/2025-06-30/hcws756

NICE, 2023 – “Evidence standards framework for digital health technologies”: https://www.nice.org.uk/what-nice-does/digital-health/evidence-standards-framework-esf-for-digital-health-technologies

Schmidt L. et al., 2024 – The three‑year evolution of Germany’s Digital Therapeutics reimbursement program and its path forward – npj Digital Medicine 7:139: https://www.nature.com/articles/s41746-024-01137-1

BMG, 2024 – Gesetz zur Beschleunigung der Digitalisierung des Gesundheitswesens (Digital‑Gesetz – DigiG), § 134 SGB V (success‑dependent price components) and § 139e SGB V (application‑accompanying success measurement): https://www.gesetze-im-internet.de/sgb_5/__134.html